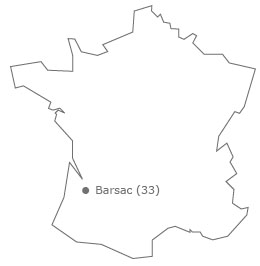

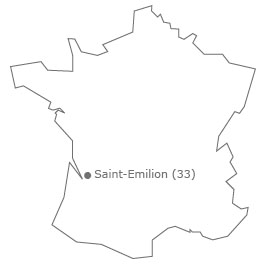

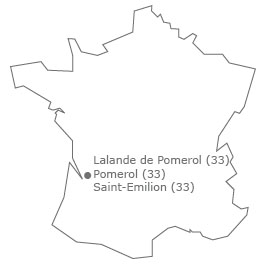

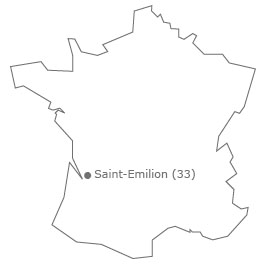

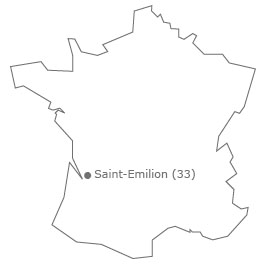

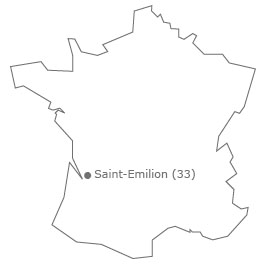

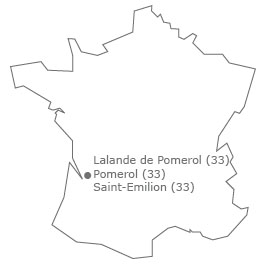

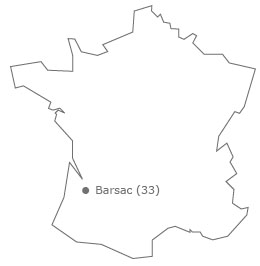

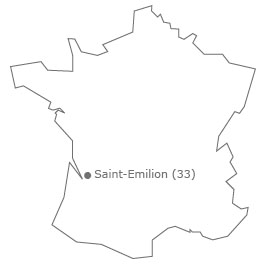

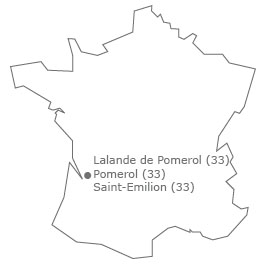

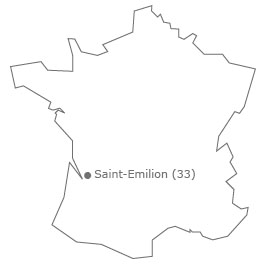

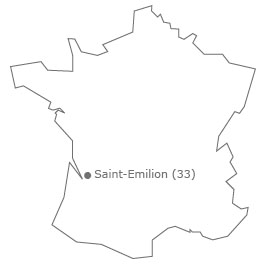

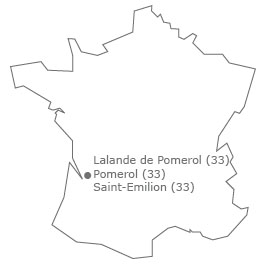

The acquisition has been completed by Philippe Castéja (through BCAP group), a figure of Bordeaux wine merchants and the managing shareholder of Borie-Manoux. The family group has over ten châteaux in the Bordeaux wine region, including the Grands Crus Classés 1855 Châteaux Batailley and Lynch-Moussas in Pauillac, Château Trotte Vieille (Premier Grand Cru Classé « B » of Saint-émilion), etc.,